If you run an insurance business or work as an agent, you’ve probably felt the challenge of hitting those sales targets. It’s not that your service lacks value—it may be that your message isn’t connecting with your audience on an emotional and logical level.

The reason?

The traditional insurance advertising strategies of generating leads don’t seem to work like they used to. People are tired of the same pitches and want something different. Another reason? People don’t wake up excited to buy a policy, and earning their trust can feel like climbing a hill in the rain.

So, how do you cut through all the noise and actually get quality leads?

This insurance advertising guide is your solution, as it covers everything you need to know to make your insurance marketing strategies smarter, sharper, and more successful in 2025.

Create Your First Insurance Campaign Now!

The Concept of Insurance Advertising

Insurance advertising is a promotional activity used by companies, agencies, or agents to promote their insurance products, such as life, health, or car insurance, to the audience. The goal is to make people aware of the need for insurance, showcase their insurance plans, and encourage potential customers to buy them. Various mediums are used to promote insurance products, including TV, radio, social media, and roadside billboards. However, the most effective strategy is displaying online insurance ads on relevant websites or blogs, which falls under digital advertising.

Essentially, insurance advertising serves as a bridge for companies or agents to highlight the benefits of being insured, such as financial protection and peace of mind. By using catchy slogans or emotional messages, they aim to attract attention, generate leads, and increase sales.

Read More: How to Meet Your Finance Advertising Goal Using Targeted Promotions

The Importance of Effective Insurance Advertising in 2025

The insurance market remains massive in 2025 — packed with promising opportunities and, yes, some tough challenges too. To stay ahead, insurance providers need to sharpen their digital marketing strategies like never before.

Let’s look at the opportunities and challenges that demand effective insurance advertising.

1) The Growing Insurance Market

According to Statista, the global insurance market is projected to reach a size of US$8.21 trillion in 2025. This huge market size presents a significant opportunity for insurance companies and agencies to capture a larger share of profits by making their advertising strategies more effective in 2025. With multiple segments like life, health, and auto insurance contributing to this value, businesses that understand their target audience and invest in brand-building campaigns will be better positioned to increase visibility, drive trust, and ultimately gain a competitive edge.

2) High Competition

The insurance industry today is very different from what it used to be. There is intense competition across all sectors—life, health, auto, and more. With so many players in the field, it has become difficult to stand out and capture the audience’s attention before your competitors do. This fierce rivalry not only drives up marketing costs but also demands innovation in messaging and delivery. This is a major challenge in 2025, and it highlights the need for sharper and more strategic insurance advertising to effectively differentiate brands and build lasting customer trust.

3) Consumer Skepticism and Trust Issues

Consumer skepticism and trust issues will continue to be major challenges for insurance providers in 2025, just as they have been in previous years. However, this challenge can be effectively addressed through targeted insurance marketing strategies. By transparently communicating what your insurance product is about—such as the problem it solves, the risks it covers, and its benefits—you can easily build trust with your audience..

4) Increased Awareness of Risk and Preparedness

In a world where everything feels a little more uncertain—whether it’s climate change or health scares—people are waking up to the reality that anything can happen. This is where insurance companies have a huge chance to step in with smart insurance advertising. Rather than just pushing products, the focus should be on educating people about the importance of being prepared.

Learn more: The Ideal Ad Network for Finance Industry Success

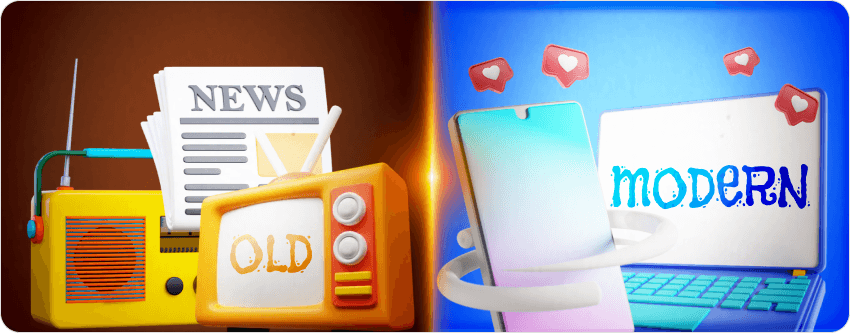

Comparison of Traditional and Digital Insurance Advertising

2025 is packed with both challenges and opportunities—but the real question is, which insurance advertising strategy will give you the edge? To make your choice easier, we’ve put together a comparison table that highlights what works best for better results.

| Aspect | Traditional Insurance Advertising | Digital Insurance Advertising |

|---|---|---|

| Audience Reach | Mostly local, limited to print, TV, and radio coverage. | Global access with niche audience segmentation |

| Personalization | One-size-fits-all messaging with little customization. | Hyper-personalized ads based on user data and behavior. |

| Speed of Execution | Long setup (printing, booking slots, approvals). | Instant campaign launch and quick adjustments |

| Tracking Results | Hard to measure results clearly. | Easy to track clicks, leads, and sales in real time. |

| Lead Quality | Many leads are not interested or relevant. | Better quality leads who are already looking for insurance. |

| Budget Control | High fixed cost, less control once paid. | Flexible—start small and increase as results improve. |

When comparing traditional and digital advertising on the basis of aspects like reach, control, and flexibility, it clearly shows that digital advertising offers everything that any insurance advertiser really wishes to have.

Discover more: Digital Advertising: A Guide to Grow Your Business Online

Top Insurance Lead Generation Strategies for 2025

There are many ways for insurance agents or companies to generate leads, but 2025 demands a different approach. This year, generic strategies won’t work. We’ve researched proven methods that you should include in your strategy to make your lead generation more effective.

1) Launch Insurance PPC Campaigns Through an Ad Network

The success of generating leads for insurance products largely depends on visibility—how often your product appears in front of your target audience while they are browsing websites, apps, or blogs. PPC (Pay-Per-Click) advertising excels in this area. By creating and launching an ad campaign using an ad network like 7SearchPPC, which offers PPC advertising services, you can effectively reach your audience when they are actively searching for insurance-related content—all within your budget.

The best part is that you will have complete control over your insurance ad campaigns. Additionally, you can track all insights and campaign performance directly on your dashboard. This is one of the most affordable insurance marketing solutions you should try in 2025, whether for life insurance advertising, health insurance advertising, or auto insurance lead generation campaigns.

To get started with generating insurance leads through PPC high-converting insurance ads, follow these simple steps:

- Research the Best Insurance Ad Networks: Identify and evaluate the top-performing advertising networks that specialize in or support insurance-related campaigns.

- Create an Advertiser Account: Sign up as an advertiser on your chosen ad network.

- Choose the Desired Ad Format: Select the type of ad you want to run (e.g., text, banner, native, video, etc.).

- Select Your Campaign Category: Choose a campaign category relevant to your product or service.

- Set Up Your Ad Campaign: Enter the necessary campaign details, including:

- Set Your Budget: Define your total and daily budget for the campaign.

- Review and Launch Your Ad Campaign: Double-check all campaign settings, creatives, and targeting. Once satisfied, launch your campaign.

(Please note that the steps outlined above are general and may vary from network to network.)

2) Capture Intent-Based Searches Using SEO

Search Engine Optimization (SEO) helps you get free traffic from Google and other search engines. It’s crucial to focus on intent-based searches—that means creating content that answers exactly what potential customers are looking for. If someone types “best car insurance company near me” into Google, and your website shows up in the top results. That brings in people who are actively searching for insurance solutions. By using the relevant keywords, writing high-quality content, and making your website fast and mobile-friendly, you can increase visibility on search results.

SEO may take longer to build compared to paid ads for insurance leads, but it delivers long-term results and consistent lead generation—without the cost of paying for each click. It’s one of the most cost-effective strategies for generating insurance leads today.

Here are the steps that can help you use SEO effectively to generate quality insurance leads in 2025

- Research high-intent keywords, such as “best life insurance provider,” and analyze the competition level for each relevant keyword.

- Create helpful, relevant content (e.g., blogs, guides, FAQs) that directly answers your audience’s questions.

- Optimize each page by including keywords in your title, headings, meta descriptions, and URLs.

- Make your website fast and mobile-friendly to improve user experience and search engine rankings.

- Build backlinks by getting featured on reputable websites, directories, or local business listings.

- Monitor your SEO performance using tools like Google Analytics and Search Console to improve over time.

Go Deeper: How to Do an SEO Audit: The Ultimate Checklist

3) Drive Leads with Targeted Email Marketing Campaigns

In 2025, email marketing stands as one of the most silent yet effective ways for insurance companies and agents to generate leads—when executed correctly. Instead of sending the same message to everyone, focus on targeted email campaigns. This means sending personalized messages to specific groups based on their needs, age, location, or past behavior. For example, you might send one message to young individuals looking for life insurance and another to senior citizens interested in health coverage.

Tools like CRM software and marketing automation can help you segment your audience and send emails at the right time. Keep your messages clear, helpful, and include a strong call to action (like “Get a Free Quote”). When emails are relevant and timely, people are more likely to open them, trust your brand, and take the next step.

Here are the steps to help you run successful email marketing campaigns for your insurance products:

- Define your ideal audience based on demographics, behavior, and insurance needs.

- Use a CRM or marketing tool to segment your email list accordingly.

- Create personalized and relevant email content for each audience segment.

- Include a clear call to action, like “Get a Free Quote” or “Schedule a Call.”

- Schedule and automate your emails for optimal timing and consistency.

- Track performance metrics and refine your campaigns based on results.

Explore more: Best Email Marketing Strategy To Grow Your Business And ROI

4) Expand Reach and Build Credibility Through Influencer Collaborations

The next effective strategy for lead generation in the insurance industry is influencer marketing. This approach has become increasingly popular among insurance agents and companies because it requires less effort compared to traditional methods and often delivers strong results.

So, who are influencers? They are individuals with a large following on various social media platforms. Influencers market products or services to their audience in several ways—through storytelling, direct endorsements, or subtle mentions within their content. In return, they charge a fee for this promotion.

You don’t need to work with celebrities. Even smaller, local influencers can make a big impact—especially if they align with your target market (like young people, families, or retirees). Collaborations can be as simple as sponsored posts, educational videos, or interviews where the influencer shares their experience with your insurance services.

This approach not only increases visibility but also makes your brand more relatable and credible—two key things that help turn views into real leads.

Follow these steps to use influencer marketing effectively for generating high-quality leads in 2025:

- Define your ideal customer profile to guide influencer selection.

- Search for influencers with strong local presence or niche authority.

- Initiate contact with a personalized pitch and clear collaboration ideas.

- Co-create content or give a marketing idea that aligns with both your insurance brand and the influencer’s style.

- Launch the campaign and monitor engagement, traffic, and lead generation.

- Evaluate results and optimize future collaborations based on performance data.

5) Use Social Media Platforms to Engage, Educate, and Convert Prospects

Social media is not just for sharing jokes, selfies, and memes— it’s where people ask for advice and recommendations. That’s your window. You can use platforms like Facebook to share quick tips, explain tricky insurance terms, or tell real customer stories. You can also create communities where you post daily content related to your insurance brand.

Social media helps in two main ways:

- When someone interacts with your insurance ads elsewhere online, there’s a high chance they’ll check your social media to learn more about your brand and credibility.

- For those not yet reached by your ads, regular posts can help you engage them organically and build awareness over time.

Use these proven strategies to generate high-quality leads through social media in 2025:

- Post daily tips that educate people about insurance in a simple, helpful way.

- Share real-life stories from customers to build trust and connection.

- Explain complex terms using short videos or infographics to boost understanding.

- Run polls or Q&As to encourage interaction and learn what your audience cares about.

- Join or create groups where you can consistently share value and advice.

- Use targeted social media ads to attract traffic to your page and generate leads.

Essential Tips for Effective Insurance Advertising in 2025

Effective insurance advertising requires a focus on two main factors: consumer behavior and the competitive landscape. Here are essential tips to guide your insurance advertising strategy this year:

1) Pick the Most Engaging Ad Format

Your insurance product and premium plans come later — the first thing that engages the audience is the ad format you use to promote your insurance products. When choosing online paid advertising for insurance promotion, select an ad format that delivers your message effectively without disrupting the user experience. Avoid pop-up ads, and instead consider using banner ads, popunder ads, native ads, and similar formats to promote your insurance products and services.

Dive Deeper: Effective Ad Formats for Increasing Website Revenue

2) Focus on Your Landing Page

Your ad brings people in, but your landing page seals the deal. Make sure it’s clear, fast, and easy to navigate. Use simple language, show your premium plans upfront, and include a strong call to action like “Get Covered Now” or “Check Your Life Plan.” When you create a customer-centric landing page, you’re much more likely to see better results.

3) Feature Pain Point-Driven and Relevant Visuals

You can use images or visuals that speak directly to your audience’s concerns, like car accidents, home damage, or unexpected health costs. This makes your ad relatable and emotionally powerful. People respond more when they see their real-life worries reflected visually. Avoid generic stock photos—use visuals that tell a story and connect to the type of insurance you’re promoting.

4) Use Testimonials and Social Proof to Build Trust

In a market full of options, people trust real experiences. Use quotes from satisfied customers, star ratings, or case studies to show that others value your insurance services. You can also show logos of companies you’ve worked with or any media features. This builds trust fast and makes new customers feel safer choosing you over a competitor. If you’re new to the insurance business and don’t have reviews yet, that’s okay. Just avoid the temptation to post fake reviews—it can seriously damage your credibility and backfire on your digital marketing efforts.

5) Implement Retargeting to Re-Engage Potential Customers

Most people won’t buy insurance the first time they see your ad. Retargeting lets you show follow-up ads to those who visited your site or landing page but didn’t sign up or take any action. These reminders keep your insurance brand fresh in their minds and give you more chances to convert them later.

Keep Reading: Retargeting Ads: Reach your Target Audience With PPC Ad Campaigns

6) Continuously Monitor Performance

Successful advertising doesn’t stop after the ad goes live. Track every step of the customer journey: who clicks, who stays on the page, who submits the form, and who actually buys. This helps you spot where people drop off. Maybe the form is too long, or the landing page isn’t convincing enough. Use analytics tools to make data-driven changes at each stage. Continuous testing and improvement can help turn more clicks into real customers.

The Future of Insurance Advertising & Lead Generation

The future of insurance advertising and lead generation is being reshaped by rapid advances in smart technology, shifts in consumer behavior, and other factors. Here is a breakdown of the key insurance advertising trends and strategies shaping this future:

1. Hyper-Personalized Marketing with AI

In the future, insurance ads will be tailored to each individual using AI. By analyzing online behavior, search history, and past purchases, AI will help advertisers create messages that feel personal and relevant. This means showing the right ad to the right person at the right time—boosting the chances of turning interest into a lead.

2. Voice Search

As more people use voice assistants like Alexa or Siri, insurance companies will need to optimize their content for voice search. Instead of typing, people will ask questions like “What’s the best car insurance near me?” Advertisers must adjust their strategies to show up in these voice-driven searches.

3. Real-Time Data & Predictive Targeting

Access to real-time data will help insurance advertisers predict when someone might need a policy, like after buying a car or moving homes. Instead of broad advertising, they can target people right when they’re most likely to buy. This predictive targeting improves ad efficiency and lowers costs. The future will be about smarter timing and smarter messaging, driven by data and customer behavior tracking.

Conclusion

It’s clear that the future of marketing in insurance is digital. With so many tools and platforms available, digital advertising for insurance companies offers more targeted, cost-effective ways to connect with potential clients. The right insurance advertising solutions can help you stand out in a crowded market and build lasting relationships. It’s not just about getting seen — it’s about getting results, and digital is the way to go.

Frequently Asked Questions (FAQs)

What is insurance advertising?

Ans. Insurance advertising is the way insurance companies promote their products (like life, health, or car insurance). They use TV, radio, social media, and online ads to create awareness and boost sales.

Why is effective insurance advertising so important in 2025?

Ans. The insurance market is huge—worth around US $8.21 trillion in 2025—and also very competitive, so effective insurance advertising solutions help you stand out and connect with potential customers.

How do PPC campaigns help with insurance lead generation?

Ans. Insurance PPC campaigns help insurance companies get leads by showing ads to people searching for insurance, driving targeted traffic to their website instantly.

Can social media be used for insurance advertising?

Ans. Yes, social media is great for insurance advertising—you can post tips, run ads, and build trust with potential clients through helpful content and interaction.

What makes a good insurance advertising strategy in 2025?

Ans. A good insurance advertising strategy in 2025 uses personalized messages, high-quality visuals, a strong call to action, and targets the right audience at the right time.

How important is the landing page in insurance advertising?

Ans. A landing page is very important in insurance advertising—it’s where visitors land after clicking your ad, and it needs to be simple, clear, and persuasive to convert them into leads.