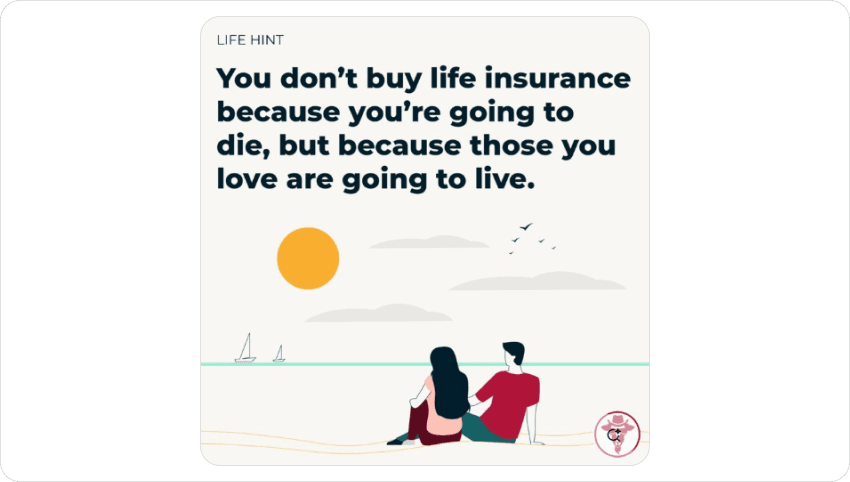

Traditional life insurance advertising has long relied on the idea of promoting FEAR – fear of death, fear of losing something – instead of making the policies easier to comprehend and build emotional transparency. As a result, users often felt disconnected and stressed.

But not anymore!

Emotional storytelling has flipped the narrative. Marketers are now utilizing storytelling as a strategic approach to build trust, credibility, and establish a lasting brand presence.

Thus, in this post, we’ll explore why stories are more effective than complex numbers and how top life insurance marketing brands are making huge profits by integrating storytelling into their ad campaigns. Let’s get started, actually, “camera, rolling… action!”

Storytelling in Life Insurance Ads: Why it Never Fails

Advertisers use storytelling to advertise life insurance in a way that inspires rather than scares. There are several reasons that show why using storytelling in life insurance ads makes lead generation effective. These reasons are:

1. Create a Narrative to Connect With the Emotions

Stories have the power to shape or alter human perspectives through compelling narratives. For instance, the TATA AIA insurance ad is changing the traditional insurance advertising and setting up a new advertising benchmark through their new ad campaign.

Their campaign slogan, ‘Kuch Income Life Ke Liye, Kuch Life Insurance Ke Liye,’ (Some income for life, some for life insurance), sets a strong dual-purpose narrative. It illustrates that life insurance isn’t just about death, but about enjoying today’s lifestyle while preparing for the future.

Changing the old, long-perceived ad marketing strategy that supports the ideology of fear.

The brand didn’t stop here. They created several more ads to promote their ad message and reach a wider audience, using copywriting such as:

- Got a big shopping basket to fill this month? Remember to add life insurance to it.

- Holiday plans? Take off here. Life insurance plans? Land here.

These ads created a narrative that resonates with Millennials and Gen Z, who aim to live life to the fullest while saving for the future. Moreover, such narratives don’t give a grim vibe like many insurance ads do.

Seriously, who wants to feel like a grim reaper is knocking at their door?

Also Read: How Insurance PPC Advertising Gives Companies the Edge

2. Builds Trust and Credibility in the Market

Sharing real-life stories of families and demonstrating how life insurance protects against life uncertainties builds trust and credibility for insurance brands.

Let’s take the example of Tata AIA again. The brand shared a review post from their loyal policyholders, Summit and Prajna Nayar, on their official Instagram page. The couple expressed their love and a desire to protect their family from life’s challenges while emphasizing their trust in the brand

View this post on Instagram

Years of service in the insurance market, combined with anecdotes, helped the brand close more potential deals.

Take this life insurance advert as an inspiration. Connect with your loyal policyholders and their families to share their experiences and showcase genuine claim settlement to create trust-building, real-life narratives.

Read: Digital Advertising Formats: What’s Coming in 2025

3. Makes Brand Reliable and Memorable

Strong emotional storytelling builds trust and makes your audience more likely to recall your brand name.

For instance, New York Life employed emotional storytelling in its ad campaign, “Love Takes Action,” which highlights love, responsibility, and security, rather than promoting features of its insurance product.

The brand reframed the traditional insurance advertising approach as a symbol of love, effectively becoming a trustworthy brand that’s easier to recall.

Let’s consider another example. The Bandhan Life used a humorous story plot, creating unconventional narratives that capture funny and culturally rich moments to simplify insurance decisions, making the brand memorable among its audience.

A weird life insurance ad idea that turned out to be a great success for the insurance company.

Also Read: How to Use Local Insurance Advertising to Boost Sales in Your City

4. Makes the Complex Terms Easier to Comprehend

No doubt, insurance terms are hard to perceive. If you aren’t in the insurance industry or just a normal user trying to comprehend policy terms and conditions. It might take a while to understand the terms, as you’ve to fetch information from multiple sources and agents.

Individuals often struggle to understand or differentiate between various policies, which leads to a lower conversion rate. Thus, to make the insurance concept easier, brands like New York Life and TruStage have created a series of content on their social handles.

These short-form videos usually feature real people (sometimes accompanied by animation) to explain policy terms through relatable scenarios in clear, easy-to-understand language.

This style of ad content fosters real-time interaction, enhances user engagement, and makes the brand more memorable.

Additionally, it helps insurance firms convert more users by establishing themselves as a trustworthy source of information.

Read: Best Strategy To Improve Ad Engagement

5. Uses Captivating Graphics to Attract Users’ Attention

Most brands use captivating graphics to present their stories in a visually appealing fashion. For instance, MetLife employs cartoon characters like Snoopy and Peanuts, as well as mascots, to simplify complex terms and form an emotional connection with its audience.

These cartoon characters have captured users’ attention, becoming popular among both older and younger demographics, while also enhancing brand credibility.

Insurance brands leverage videos, infographics, and illustrations to make their ad messages more appealing and easier to comprehend through storytelling.

The visually appealing stories break down complex terms, encouraging users to invest more time in learning and achieving financial independence.

Also Read: Strategic Advertising: Key Strategies for Online Growth

Effective Storytelling Tips for Creating Life Insurance Ad Campaigns in 2025

Use these tips to effectively practice storytelling in your next campaign and brainstorm innovative life insurance advertisement ideas:

- Create a user persona. Give a name to your fictional character, define their real-life problems, and highlight your insurance product as a solution that resonates with them in a natural manner without diverting the main storyline.

- Experiment and learn from competitors. Analyze how your competitors are employing storytelling to differentiate themselves from traditional “feature-focused” ads, and what you can learn from them.

- Use influencer marketing. Nowadays, many popular life insurance companies collaborate with stand-up comedians and social influencers to promote their products through organic storytelling that makes people laugh.

This approach raises awareness of the importance of financial planning, establishing the brand as a trustworthy source, and making it easier to recall. - Social platforms dominate ad growth. People are now spending more time consuming content from their favorite social influencers rather than the traditional entertainment channels like TV.

By leveraging emerging social platforms, you can utilize word-of-mouth marketing to promote insurance services to a wider audience that’s already engaged and trusts influencers’ recommendations. - Use AI to create impactful life insurance ads. AI tools can help you retrieve users’ demographic details, interests, behavior, and problems to outline the main characters and create a strong story around them.

- Define your ad campaign. Outline campaign goals, budget, and timeframe to maintain the quality and frequency of your ads.

- Make stories more culturally and regionally specific. This makes life insurance adverts feel more relatable and forms an emotional bond with the target audience, making the ad messages more potent.

- Measure and analyze to perform better. Evaluate how storytelling in life insurance ads is working for your brand and identify the steps needed to enhance your storytelling to better connect with the emotions of humans.

Create authentic stories that feature characters to connect with, conflict to illustrate problems, and a resolution that resolves the issue, evoking empathy and resonating with real-life problems.

Also Read: Power of Keywords: An In-Depth Analysis of PPC Keyword Research

Conclusion: Storytelling Strengthens Life Insurance Commercials

Storytelling in life insurance advertising is a hot topic in marketing, as many advertisers have begun incorporating storytelling into their ad strategies. This helps them connect with the younger generation that wants to enjoy life’s pleasures while preparing for the future.

Storytelling is worth the investment, and it has proven to be an effective asset for many insurance brands. It simplifies complex concepts and generates leads that are more likely to convert into policy buyers and so much more.

We have mentioned some of the popular life insurance advertisement ideas created by top brands that leverage creative storytelling, breaking the traditional fear-based approach. Try to take inspiration from these life insurance ad creative ideas for your next insurance campaign.

Create ads that inspire people and change their perspective on lifestyle, rather than coming across as a feature-focused product or a grim reaper.

Frequently Asked Questions

What are the life insurance marketing trends for 2025?

Ans. Insurance brands leverage AI to create user personas, analyze user behavior, and develop personalized insurance ads that utilize storytelling in short-form videos and engaging graphics.

How do life insurance ads benefit insurance companies?

Ans. Life insurance advertisements build trust, evoke emotions, and foster engagement to enhance awareness, generate leads, and create a lasting legacy.

How storytelling drives trust and engagement in life insurance ads?

Ans. Storytelling drives trust and engagement in life insurance ads by connecting with human emotions, streamlining complex insurance terms, and illustrating brand value through real-life scenarios.

What are the digital marketing strategies insurance brands can leverage to boost awareness and build trust?

Ans. Insurance brands can leverage popular digital marketing strategies, such as influencer marketing, referral marketing, search engine optimization, social media, and content marketing, to increase lead generation, awareness, and trust.

Do traditional life insurance advertisements continue to be effective?

Ans. Traditional insurance advertising, like TV, print, and radio commercials, isn’t obsolete or incompetent. Advertisers can create hybrid insurance advertising strategies to raise awareness, trust, and engagement across diverse demographics.

How to acquire bulk impressions and clicks from life insurance advertisements?

Ans. Connect with influencers who have moderate to high follower counts and can naturally promote your brand message, thereby creating trust among their users.

Advertisers can also connect with ad networks that offer bot-free traffic to acquire genuine and bulk impressions/clicks for their ads for life insurance. For instance, consider using the 7SearchPPC ad network, which features a clean and simple dashboard with robust functionalities.

Apart from storytelling, what other ad creative ideas can insurance brands employ?

Ans. Apart from storytelling, insurance brands can leverage various life insurance advertisement ideas, including customer testimonials, collaborations with influencers, interactive advertising, and practice copywriting with SEO keywords.