There is a quiet truth in the insurance world no one likes to say out loud: the best insurance provider doesn’t always win — the most visible one does. You could have the sharpest product knowledge, a flawless track record, and a five-star reputation… but if your competitors show up before you on websites, blogs, or even Google searches, you’ll lose potential leads before you even get a chance to compete. That’s where the need for insurance PPC advertising comes into the limelight.

It is a powerful strategy that can put your insurance services directly in front of people actively searching for risk coverage or life term plans. It’s fast, targeted, and, when done right, incredibly cost-effective.

In this blog, we’ll break down how insurance PPC campaigns can give your business the edge it needs to generate high-quality leads and drive growth.

Launch Your Insurance Advertising Campaign Now!

What is Insurance PPC Advertising?

Insurance PPC (pay-per-click) advertising is a smart strategy designed specifically for insurance companies and agents. It involves placing ads on search engines, websites, blogs, or social media platforms, with payment required only when someone clicks the ad. This approach allows insurance providers to target specific audiences based on keywords, location, or demographics, ensuring that their advertising efforts focus on reaching people actively searching for insurance solutions online.

The goal is to drive high-quality traffic and quickly generate leads by placing insurance ads directly in front of users who are either searching for coverage or engaging with relevant content.

Read on to learn more: Insurance Advertising: Attracting Policyholders with Innovative Campaigns

Here is how insurance PPC ads appear across various digital platforms

»On Search Engines (e.g., Google Search Results)

(This is an example that clearly shows that the ad is shown for the insurance companies that bid on the keyword “insurance.” When someone enters “insurance” into the search box, the PPC ads for insurance companies are triggered.)

»On Insurance Websites

(The image above shows how insurance ads appear on insurance websites. When people browse these sites, they may encounter PPC insurance ads, engage with them, and take action.)

»On Insurance Blogs

(The image demonstrates how pay-per-click (PPC) insurance ads are integrated into insurance-related blogs. While exploring these blogs for details on coverage options, benefits, and different insurance plans, users may notice these ads, click on them, and proceed to take further steps.)

Why PPC Matters in the Insurance Industry

Pay-per-click (PPC) advertising matters significantly in the insurance industry for its strategic impact, competitive advantage, and ability to drive high-intent leads. Here is a breakdown of why PPC is so important in this sector:

1. Immediate Visibility and Leads

PPC ads give your insurance business instant exposure online. Instead of waiting for your website to climb search rankings, PPC places you right at the top when people search for insurance. That means more eyes on your insurance services and more chances to turn clicks into real leads. It’s a quick way to start getting calls, quotes, or sign-ups without the long wait that comes with organic marketing efforts.

2. Highly Targeted Advertising

One of the biggest benefits of PPC is that you can precisely target your audience. Many PPC ad networks offer advanced targeting features for insurance advertisers, allowing them to target their advertisements based on aspects such as location, age, keywords, and even the devices users are using. This means you’re not wasting money on people who aren’t interested. Instead, your online insurance company ads reach the exact group of potential customers who are already looking for what you offer.

See the full post: Boost Your Ads with Precision: The Power of Location-Based Targeting

3. Full Budget Control

With PPC ads for insurance, you’re always in control of how much you spend. Whether your budget is big or small, you can set daily or monthly limits that suit your goals. You only pay when someone actually engages with your ad, so there is no wasted spend. And if something is not working, you can pause, adjust, or stop insurance ad campaigns at any time. It’s flexible, cost-efficient, and gives you peace of mind over how your insurance advertising budget is spent.

4. Measurable Results and ROI

Insurance PPC advertising campaigns are easily trackable. You can see exactly how many people saw your ad, clicked on it, and took action—whether that’s filling out a form or purchasing an insurance plan on your website. This makes it easy to measure your PPC ROI (return on investment) and make smarter marketing decisions. Unlike some traditional methods, PPC gives you clear data so you know what’s working and where to improve.

5. Competitive Advantage in a Crowded Market

The insurance industry is packed with high competition, but PPC helps you stand out. By displaying your insurance ads on search engine results pages, websites, and blogs at the exact moment your audience is searching, your brand remains visible while others compete for attention. Even if your competitors are ranking organically, a well-placed ad can leapfrog you ahead of them. With the right marketing strategy, PPC puts your services in front of the right people at the right time—before they find someone else.

Best Practices for a Successful Insurance PPC Campaign

Running a successful PPC for insurance campaigns —whether it’s auto, life, health, or home—requires a strategic approach. The insurance industry is highly competitive in paid ads, with aggressive bidding environments and stiff competition from major brands. Below are the best practices for running a successful insurance PPC advertising campaign to generate high-quality leads and maximize ROI.

1) Establish Measurable Campaign Objectives

Before you spend a dime on ads, know exactly what you’re aiming for. Do you want more insurance lead generation, or are you looking to sell more insurance plans? Set goals that are clear and trackable. If you run insurance PPC ad campaigns without any goal, you will struggle to measure success and improve results over time. So, don’t just “run ads”—run them with purpose and know how you’ll define success.

2) Identify and Segment Ideal Customers

Not everyone searching for insurance is your customer. Some are looking for auto coverage, while others are interested in life or health insurance. That’s why it’s important to filter prospects based on the type of insurance service you offer. Also, break your audience into smaller groups based on what they need, where they live, or how old they are. This way, you can speak directly to your ideal audience instead of showing your insurance ads to everyone, which can lead to wasted ad spend.

3) Evaluate and Select a High-Performing PPC Ad Network

After conducting some initial research on audience segmentation, the work is still ongoing. The next step is to evaluate and select a high-performing PPC ad network. First, prepare a list of the best PPC platforms for insurance advertising, and then evaluate them based on the following criteria.

- Targeting capabilities (Location-wise, Device-wise, Operating system-wise),

- Traffic quality,

- Pricing-Models (CPC, CPM)

- Multiple Ad Formats (Text ads, Banner ads, Native ads, In-page push ads, Popunder ads),

- Performance tracking and analytics,

- Compliance with insurance industry regulations.

By doing this, you can easily find the best PPC ad network to launch your insurance campaigns and achieve success. You can also look into using social media platforms like Facebook and Instagram for your insurance PPC ads—they offer great targeting options and engaging ad formats that can really work well.

Find out more: Checklist for Choosing the Right Ad Network: Key Criteria and Tips

4) Use Specific, High-Intent Keywords

When people search for insurance, they often use specific phrases like “affordable car insurance near me” or “life insurance for a salaried person.” These are high-intent keywords that show the person is already interested in buying. So, what should you do?

Start by researching both short-tail and long-tail keywords that people are using to search for insurance products and services relevant to yours. Then, check the bid price for those keywords. Are they affordable? If so, bid on them for your insurance ppc advertising campaigns. If not, look for other keywords that have high search volume, are relevant to your insurance offerings, and have a more affordable bid price.

Read more: Power of Keywords: An In-Depth Analysis of PPC Keyword Research

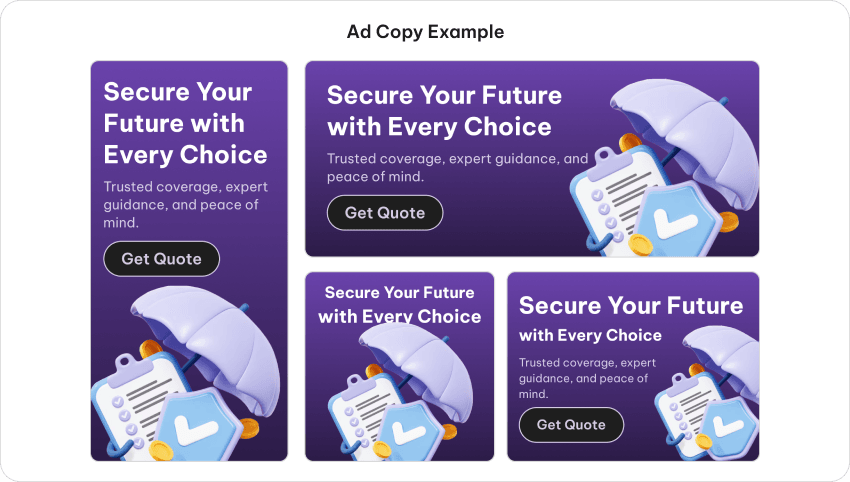

5) Create Highly Relevant Ad Copy

Your insurance ad copy is the first thing your ideal customers interact with, so it needs to be highly attractive. The terms often used in the insurance industry can be difficult for some audiences to understand, so it’s important to be careful when including them. Instead, use simple language and short, impactful messages that speak to your customers’ pain points. Pair these with relevant visuals and an action-oriented call to action (CTA).

You should be strategic when choosing an ad format because the right one can showcase your insurance message more effectively. To get the best results, you can try popunder, banner, and text ads for your insurance PPC advertising.

The above example of a life insurance ad copy shows a happy family walking together, highlighting protection and security. The message asks, “What happens to your family if tomorrow comes too soon?” and urges viewers to secure their loved ones’ future with a free quote. You can create your ad copy in this way, which will surely catch the attention of your audience quickly and help you generate more leads.

Learn more about this topic: Upgrade Your Writing Skills for an Irresistible PPC Ad Copy?

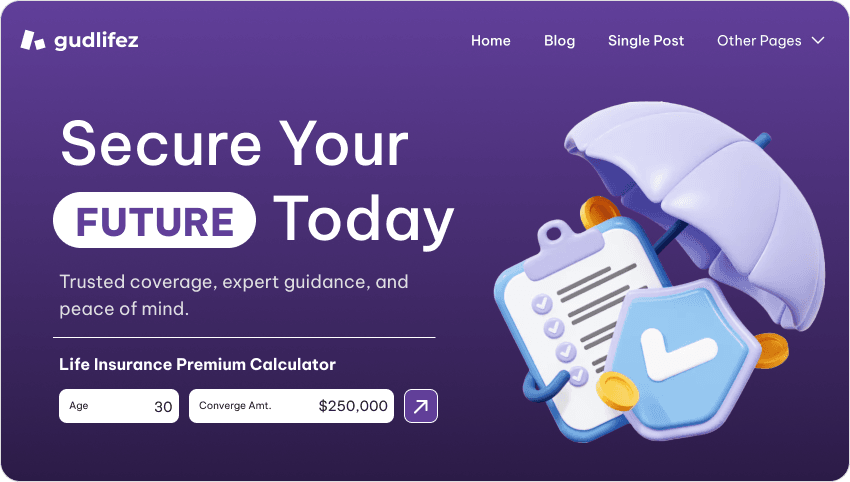

6) Design a Conversion-Focused Landing Page

Getting a user to click your ad isn’t enough—you need to carry them smoothly to the next step. This is where a landing page plays an important role in making insurance advertising strategies successful. A strong landing page should be simple, visually clean, and aligned with your ad copy. If your ad says “Get a free life insurance quote,” the landing page should deliver that promise right away. Place easy-to-fill forms, clear benefits, and visible contact information. If you add trusted badges to your landing page, it will be more beneficial for you.

Never forget to add interactive elements, such as a life or health insurance premium calculator, to your landing page, as they can help users quickly estimate costs, compare plans, and make informed decisions.

7) Target Your Ad Campaign Strategically

Are all things set? No, there is still something that remains, which decides the success of PPC in insurance advertising, and that is a strategically targeted insurance PPC campaign.

During the campaign setup process, you’ll be given several targeting options. It’s important not to make these decisions blindly. Instead, base your targeting strategy on research — focus your ad campaign where the majority of your audience is most active and lives.

For example, if your insurance company operates in the USA and your research shows that most of your audience is located in cities like New York, Chicago, or Los Angeles, then targeting those cities in your campaign would be a smart choice.

8) Set Your Budget

Your budget determines how much exposure your insurance ads can get, so it needs careful planning. You can decide your budget by keeping all the factors in mind, like your marketing goals, target audience, campaign duration, and available resources. One mistake people often make is spreading their budget too thin. Instead, focus on a few strong campaigns and allocate enough funds for them to perform well. A smart budget brings consistent results without overspending.

Explore more: Advertising Budget: Where to Spend and How to Save

9) Place a Competitive Bid

Bidding in PPC works like an auction: you’re competing with other insurers for quality ad space. Now, the question is: what bidding strategy is perfect — too high or too low? The best approach is to research average costs-per-click in your niche and adjust your bids strategically. Sometimes, paying slightly more for the right keyword pays off because of higher-quality leads.

Also read: What is the Best PPC Bidding Strategy?

10) Track and Measure Performance

Running an insurance PPC advertising campaign without tracking results is like guessing in the dark—you never really know what is working. You must keep a close watch on key numbers like how many people click your ads, how much each lead costs, and whether you’re making a profit. You’ll have access to real-time analytics through the advertiser dashboard provided by your chosen ad network.

Conclusion

In the competitive insurance market, visibility is everything. That’s why PPC for insurance companies and PPC for insurance agency campaigns can make all the difference. With the right strategy, your insurance company’s advertisement reaches people who are actively looking for coverage. Insurance ppc advertising is fast, targeted, and trackable—helping you get more leads without wasting your budget. If you want your insurance business to grow smarter, not harder, PPC is the best strategy to consider.

Read More:- Top Insurance Advertising Trends Every Marketer Should Know in 2025

Frequently Asked Questions (FAQs)

What is insurance PPC advertising?

Ans. Insurance pay-per-click advertising is a type of advertising model where insurance companies pay only when someone clicks their ad. It helps insurance providers reach people who are actively searching for coverage.

How does PPC for insurance companies work?

Ans. PPC works by showing your insurance ad on search engines, websites, or blogs. When someone clicks on your ad, you pay a small fee. It helps bring targeted traffic to your insurance website.

Why should insurance companies use PPC ads?

Ans. PPC helps insurance companies get instant visibility, target specific customers, and drive leads without having to wait for organic search rankings.

What kind of insurance companies can benefit from PPC ads?

Ans. Any insurance company—whether it’s for auto, life, health, or home insurance—can use PPC ads to generate more leads and attract new customers.

Is PPC for insurance expensive?

Ans. PPC can be affordable depending on your budget. You control how much you spend and can adjust based on performance.