Latin America doesn’t need to be “introduced” to gambling; it’s already part of the culture, just in different forms. In 2024, the online gambling market took a giant leap forward, with sportsbooks playing a central role. The sector generated an impressive revenue of USD 5,330.9 million, showing the promising market for those still figuring out the regions for gambling promotion. This growth indicates that gambling traffic in Latin America is on the rise.

From neighborhood football bets to national lotteries, the demand for gambling is strong. What’s changing is how people play, with more turning to online platforms and smartphones for personalized entertainment. This shift presents a clear opportunity for iGaming brands.

The road to success may seem easy, but it’s not. With so many advertisers trying to capture the attention of the Latin American gambling audience, many miss the mark by using the wrong strategies. This market is far from a one-size-fits-all approach. To succeed, you need proven strategies, and that’s exactly what you’ll find in this blog.

We’ll explore everything about gambling advertising in Latin America, including proven strategies to engage iGaming traffic in the region.

Why Pursue Gambling Traffic in Latin America?

The biggest fear of most gambling advertisers is the investment they put into targeting convertible traffic through their ad campaigns. So, the question is fair to ask: Why target gambling traffic in Latin America when other regions are available? The best answer we have is the high growth of the iGaming market and the favorable conditions in the region.

The betting market in LatAm is expected to grow markedly from 2020 to 2025, reaching over 3 billion U.S. dollars (source: Statista). This is absolutely remarkable and presents a significant opportunity for betting platforms to enter, participate, and capture a share of the profits.

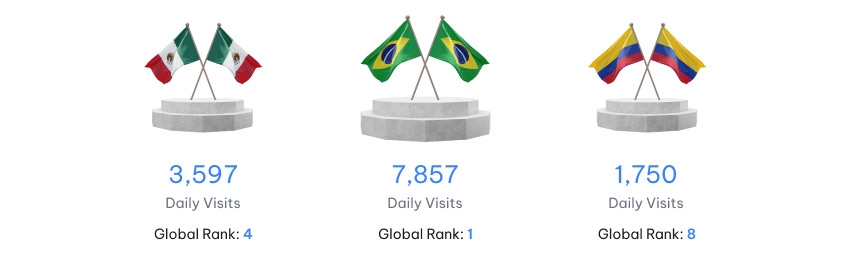

The three countries that mainly played an important role in this growth are as follows:

- Brazil

- Mexico

- Colombia

Experts also suggest that the growth is largely due to Brazil’s successful enforcement of online gambling regulations.

What Makes Latin America the Perfect Market for Gambling Ads

We are not claiming that LatAm is inherently superior, but if you want to buy gambling traffic, then this market is ideal for you. What makes it superior is your sportsbook advertising effort and the effectiveness of the ad network you have chosen.

If you’re looking to use 7SearchPPC, you should focus on your advertising strategy, as we have already proven the effectiveness of our ad network. Our past campaigns serve as evidence.

Get Ahead — Tap Into Gambling Traffic In Latin America!

To learn more, take a look at this case study, “How 7SearchPPC Powered Clients’ Success in the iGaming Industry.”

How 7SearchPPC Powered Clients’ Success in the iGaming Industry

Let’s come to the point. Below are some factors researched by the 7SearchPPC team that will surely convince you why targeting gambling traffic in Latin America is a wise decision.

Widespread Acceptance of Betting Games

Do you know why most advertisers step aside when it comes to targeting gambling traffic in Latin America? Because they believe people won’t accept it. But in doing so, they miss the real opportunity.

In LatAm, betting is something people grow up seeing. It’s part of normal life, like cheering for your football team or playing games with friends. Many people place bets for fun, and no one sees it as strange or bad. Because of this, iGaming doesn’t feel scary or risky to most. That’s why ads for betting fit in so well; they match what people already enjoy and understand.

Market Size

Above, we discussed that the Gross Gaming Revenue (GGR) of the gambling market in LatAm is around $3 billion, up from $1.3 billion in 2020. This significant growth in market size indicates two things: first, that sportsbook platforms are experiencing a high volume of traffic from LatAm; and second, that this growth is unlikely to stop here, with new milestones expected to be reached every year.

Now, it’s time to discuss the country-wise rankings.

There are thirty-three countries in Latin America, out of which three have successfully held their positions among the top ten countries based on daily visits to online casino websites.

Here is the data:

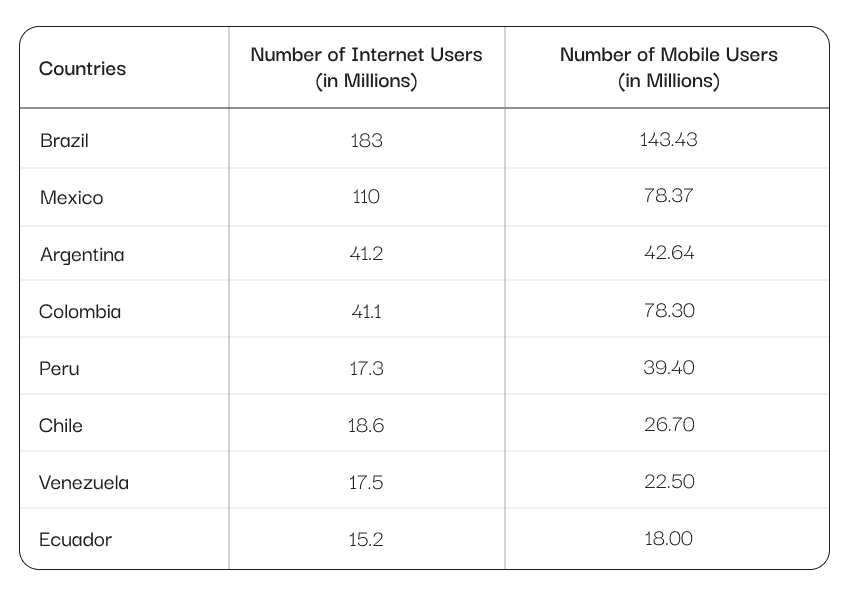

Growth of the Internet and Mobile Penetration

Gambling is often popular among people who enjoy playing from the comfort of their homes or other places. This is only possible in regions with strong internet connectivity and a large number of mobile users.

Below are the separate figures for mobile and internet users in eight Latin American countries.

The number of internet users in these Latin American countries is obtained from Statista, while the number of mobile users is gathered from various sources. The mobile user figures include both smartphone and basic phone users.

If we consider all the remaining countries in the region, Statista estimates that by 2025, the region will have over 422 million mobile internet users. The widespread use of mobile devices and the internet signals a prime opportunity for sportsbooks to target users.

Legalization of Gambling

Online gambling laws are not the same in LatAm, as they vary from country to country. Colombia and Mexico have established clear iGaming regulations and licensing systems, making it legal and well-regulated.

In contrast, countries like Brazil are only beginning to open up the market, with new iGaming laws being introduced. In many other nations, the legal status remains a gray area, permitted but not fully regulated.

Below is the legal status of gambling in some of the most popular countries in high demand among advertisers targeting gambling traffic in Latin America.

- Brazil:- Gambling in Brazil was banned for many years, but things are changing. In 2018, the government drafted a law to regulate sports betting, and after that, they worked on more laws to legalize and regulate other types of gambling, like casinos. The year 2023 brought new opportunities for sportsbook platforms, as Brazil made a major move in regulating the industry by passing a law that allows both online and land-based sports betting.

This development, supported by President Lula da Silva, marks a significant step after years of delays. Brazil has been facing a major job shortage and issues with tax collection. With this move, they believe they can address both problems.

The goal is to create jobs and increase tax revenue. While not fully legalized yet, Brazil is moving towards a more open iGaming market with clearer regulations.

- Argentina:- Argentina allows several forms of gambling, including casinos, lotteries, and online betting, but each province sets its own rules. For example, Buenos Aires has a large legal gambling market, including online platforms. The government uses gambling revenue to fund public programs. Although iGaming is legal, authorities also try to control illegal betting and promote responsible gambling through local regulations.

- Colombia:- Colombia is one of the first Latin American countries to regulate online gambling. The government legalized it in 2016 through a national body called Coljuegos. Licensed operators can offer games like online poker and sports betting. Gambling in physical casinos and lotteries is also legal. The rules are strict, but the industry is growing steadily and is seen as a successful model in the region.

- Mexico:- Mexico has allowed gambling for many years, but the laws are outdated compared to those of other countries. Casinos, sports betting, and lotteries are legal, but many operate under old permits. The government is working on updating the laws to better regulate the industry and attract investors. While legal gambling exists, there is a need to push for improved transparency.

Rising Disposable Income

The projection for disposable income in LatAm is very promising and favorable for sports betting platforms. Why? Because disposable income is expected to increase by 60% by 2040 (Source: Trafficguard). As disposable income grows in the region, more people will have the financial freedom to spend on playing betting games.

This growing purchasing power makes LatAm an attractive market for iGaming ads, as more people are likely to engage in such entertainment.

Statistics on iGaming in LatAm

iGaming in Latin America (LatAm) has experienced significant growth in recent years. There are many factors behind this, like changes in regulations, increased internet and mobile penetration, and the region’s deep love for sports like soccer, basketball, and baseball. Here is a breakdown of the statistics and trends surrounding sports betting in LatAm:

Expanding Growth in the LatAm Region

- The iGaming sector in Latin America has grown by 38%.

- The market value will grow from $21 billion in 2023 to $54 billion in 2026.

Country-Specific Growth

- Argentina generates $2.4 billion in revenue every year.

- Nearly 90% of sports betting operators intend to enter the Peruvian market within the next 5 years.

Sports Watching Habits in LatAm

- Around 90% of people in Latin America watch at least one sport every year.

- In 2020, 56 million people in LatAm watched esports, and this number has likely grown in recent years.

Engagement in Sports Betting

- 46.14% of the people in the region are involved in sports betting.

- People in the 25-34 age range are the most active when it comes to betting.

The source of the data above is Trafficguard. Please note that this data may change each year due to the rapid development in LATAM, particularly in the context of gambling and sports betting.

Top GEOs to Target for Gambling Traffic in Latin America

A total of 33 countries make up Latin America, but not all of them are on the same page when it comes to betting. Some countries have legalized it, some have banned it, and others are still debating it. Therefore, it makes sense to focus on the countries in LatAm where betting is legal, as they offer more opportunities for profit through iGaming ad campaigns.

The 7SearchPPC team has researched these countries and gathered additional insights that can help you decide on targeting gambling traffic in Latin America. Please have a look.

Colombia

Many of you may have already guessed that we are going to put Colombia at the top of the list for targeting gambling traffic in Latin America. This is because Colombia was the first country in the region to legalize gambling. The population is around 53.4 million, and the number of users is expected to reach 9.1 million by 2029. User penetration in the gambling market is projected to be 29.6% in 2025 (Source: Statista).

We have collected the official statistics for you. These figures may help you directly or indirectly in deciding whether to target Colombia for iGaming ads.

- Legal age for gambling: 18 years or above.

- Age Group (Most Active iGamers): 18-44

- Gaming Tax: 19% VAT on every deposit.

- Revenue: US$4.96 bn (expected) by 2025.

- Currency: The Colombian Peso

What does 7SearchPPC suggest?

Colombia is also a top choice among advertisers on our platform as a key hub for gambling traffic in Latin America. Its economic growth and the population’s strong interest in gambling make it an attractive market for sportsbook platforms.

The top cities you should target are Bogotá, Medellín, Cali, and Barranquilla, as they offer access to a large number of potential players. We recommend using banner ads, in-page push, and popunder formats to achieve the best results for your ad campaign.

Mexico

Mexico is a huge market with millions of potential users. The country’s population is around 131 million, and the number of users is expected to reach 24.1 million by 2029. User penetration in the gambling market is projected to be 36.3% by 2025.

While gambling laws can be a bit outdated, online betting is widely accepted and continues to grow. Sports betting is especially popular, and many people bet on both local and international events.

Mobile betting is rising fast, and people are actively looking for sportsbook platforms that offer cash and bonuses on every deposit. With its large population and betting culture, Mexico is a strong market for targeting gambling traffic in Latin America.

Here are the official statistics we’ve gathered. This information may assist you in deciding whether to target sportsbook ads in Mexico.

- Legal age for gambling: 18 years or above.

- Age Group (Most Active iGamers): 18-34

- Gaming Tax: VAT is subject to certain terms and conditions, but the corporate tax rate for iGaming operators is 30%.

- Revenue: US$12.37 bn (expected) by 2025.

- Currency: The Mexican Peso

What does 7SearchPPC suggest?

To effectively target the Mexican market, focus on major cities like Mexico City, Guadalajara, and Monterrey. You can use the ad formats that don’t make so much noise, like Text ads, and are effective, especially on mobile. Promote offers like cashbacks and bonuses to attract users. Also, consider running iGaming ads around local sports events to capture the audience’s interest.

Argentina

Argentina is another big player in the Latin American gambling scene. The country has recently modernized its sportsbook laws, making the market more open to online platforms. If we talk about the population, it is around 45 million. In the gambling market, the number of users is expected to amount to 11.7 million by 2029. User penetration in the gambling market will be 50.7% in 2025.

Argentinians are passionate about sports, particularly football, so sports betting is very popular. With a growing number of people using the internet for leisure activities, Argentina is a prime market for iGaming operators looking to expand.

Here are the official stats we’ve collected. They might help you decide if advertising gambling in Argentina is a good idea.

- Legal age for gambling: 18 years or above.

- Age Group (Most Active iGamers): 18-34

- Gaming Tax: (5% to 15%, depending on the operator)

- Revenue: US$6.41 bn (expected) by 2025.

- Currency: The Argentine Peso

What does 7SearchPPC suggest?

When targeting Argentina’s gambling market, 7SearchPPC recommends focusing on Buenos Aires, Córdoba, and Rosario, cities known for their rich sports culture. Argentina is a key market, and missing out on it means losing the chance to attract potential iGamers in LatAm.

A large portion of the Argentine population uses both laptops and mobile devices for online browsing, making ad formats like banner ads and popunders effective for driving engagement and supporting the success of your iGaming campaigns.

The countries mentioned above fall into the ‘must-not-miss’ category when targeting gambling traffic in Latin America. While Brazil is also worth considering, we have excluded it due to its comparatively late approval of online and offline betting.

Top Ad Creative Ideas for Targeting Gambling Traffic in Latin America

Gambling in LatAm is so popular, and now you can understand why. So, what’s next? It’s time to explore ad creative ideas that will help you effectively target the gambling traffic in Latin America.

Use Local Language and Slang

Always write your ads in the local language (Spanish or Portuguese) and, if possible, use popular slang. This makes your ad feel more relatable and native to the audience. Also, avoid using Google Translate, as it can’t give you the touch that your ad should have; real localization builds trust, and your iGaming platform will see better engagement and conversions.

Focus on Popular Interests Like Football

Football has a huge fan base in LATAM. Ads that include popular teams, players, or matches instantly grab attention. If there’s a big game coming up, connect your betting offer to it. Here’s an example of how you can do this:

- Headline: “Argentina vs. Brazil – Bet Live Now!

- Visual: Side-by-side jerseys with an odds overlay (e.g., “Win 3.2x”)

- Localization: Spanish/Portuguese versions, team colors, and Latin-style fonts

Show Trusted Payment Methods

Highlight local payment options like Pix (Brazil), OXXO (Mexico), or PSE (Colombia). Seeing familiar and trusted logos makes users feel safer when depositing money. It also shows that your platform supports their country’s payment system. This approach can effectively attract more gambling traffic in Latin America.

Make the Offer Clear and Urgent

Customers won’t put their hands in their wallets and give you money until they think they might miss the offer, that is FOMO, and you must show it in your betting ad to attract gambling traffic in Latin America.

Use strong, clear offers like “200% Bonus Today Only” or “Get $30 Free on First Bet.” Adding urgency (like “Ends Tonight!”) pushes users to act quickly. Keep your message short and direct so people know exactly what they’re getting.

Match the Look of Your Landing Page

Your ad should look and feel similar to your landing page—same colors, logo, and theme. This makes the experience feel smoother and more professional. If the ad looks different from the website, users might get confused or lose trust.

Quick and Smart Tips for Launching Gambling Ad Campaigns

Here are some tips to help you stay compliant, competitive, and goal-focused when launching iGaming ad campaigns aimed at attracting gambling traffic in Latin America.

Pick a Clear Objective

The first step every sportsbook advertiser must take is to define their goal. Remember, every campaign should be based on a clear objective. You can launch an ad campaign without a defined goal, but think about it, how will you measure performance at the end? More importantly, will the results actually benefit your business in the way you intended? That’s why setting a clear objective is essential.

Double-Check Regional Compliance

Many advertisers forget to thoroughly review local gambling advertising laws and platform-specific policies before launching. Always verify which regions allow iGaming ads and target your ad campaigns accordingly to avoid bans or account suspensions and successfully engage gambling traffic in Latin America.

Consult an Expert for Help or Suggestions

It’s important not to rush into creating an ad campaign to engage gambling traffic in Latin America. Instead, take advice or guidance from an expert. At 7SearchPPC, we have professional ad managers who not only give guidance but also support your ad campaign in every possible way. This can save you ad budget and time, and also give you the desired results in LatAm.

Target According to Research and Plan

As we previously discussed, LatAm consists of 33 countries, but where do you get the best results? To attract the most gambling traffic in Latin America, you need to research the locations, devices, and operating systems where your target audience is most active. Based on this research, you can then target them effectively through gambling advertising campaigns.

At 7SearchPPC, we offer multiple targeting options: by country, state, city, operating system, and device, because we understand how important precise targeting is to making your ad campaigns successful.

Keep Experimenting to Get the Best Results

Testing helps you find the winning formula so your campaign improves over time. You must experiment with different ad formats, bids, ad copies, targeting options, and all other possible elements. Keep in mind that the goal is to achieve better results, not to make things worse. This experimentation will help you find the best combination for your ad campaign to attract gambling traffic in Latin America.

Conclusion

Gambling is already part of everyday life in LatAm, and with more people using the internet and smartphones, the opportunities are growing fast. Each country has its own rules and habits, so it’s important to understand the local market. For advertisers who take the time to learn and adapt, there’s a big chance to catch more gambling traffic in Latin America. The market is ready to grow; now is the perfect time to jump in and make the most of it.

Frequently Asked Questions

What is gambling traffic in Latin America?

Ans. Gambling traffic in Latin America refers to the number of people in the region who visit betting websites or use online iGaming apps

Why is gambling traffic in Latin America growing fast?

Ans. Gambling traffic in Latin America is rapidly increasing due to more people having smartphones and internet access, making it easier to play betting games online.

Which countries have the most gambling traffic in Latin America?

Ans. Argentina, Mexico, and Colombia have the highest gambling traffic in Latin America due to large populations and growing online betting markets.

Is Gambling Traffic in Latin America accepted by local culture?

Ans. Yes, gambling traffic in Latin America is accepted because betting has been part of the culture for a long time, like football bets and lotteries.

What age group forms the largest part of the gambling traffic in Latin America?

Ans. The age group between 18 and 44 forms the largest part of the gambling traffic in Latin America, as they are most active in online betting.