Billions of people across the globe purchase insurance every year, for good reason. Life is unpredictable, whether it’s a medical emergency, a car accident, property damage, or an unexpected loss, insurance offers a financial safety net that helps people protect what matters most: their health, their loved ones, and their assets. It is not just a product, it’s peace of mind.

People understand this. That’s why they invest in insurance, often before they need it.

But in today’s digital world, selling insurance isn’t as simple as knocking on doors or cold-calling potential clients. Those outdated methods rarely yield results anymore. So, how do insurance companies reach the people who need their protection the most? How do they grow in an increasingly competitive market?

That’s where effective insurance marketing comes in. The right approach does not just promote policies—it builds trust, educates consumers, and connects insurers with the people they are meant to serve.

In this article, we will explore the best insurance marketing strategies that not only expand your client base but also help you generate income with ease and minimal hassle. So let’s explore the best ways to promote your insurance company.

Launch Your Insurance Advertising Campaign Now!

Why Having Insurance Marketing Strategies Is Crucial

Having effective marketing strategies for insurance brokers is essential for several important reasons. In a competitive and trust-driven industry like insurance, it’s not enough to just offer a policy; companies must actively communicate their value, target the right audience, and build lasting relationships. Here’s why insurance marketing strategy is important.

Intense Competition in the Industry

One key reason insurance marketing strategies matter is intense industry competition. With many companies worldwide using different strategies to gain an edge, effective marketing helps your company stand out by analyzing competitors and improving your approach to perform better.

Knowing what kind of approach your competitors are using gives you an advantage to do better by focusing on areas where they are weakest, because the chances of maximizing revenue and performing better depend on this strategy.

Attracts New Clients & Boosts Leads

In today’s competitive market, having effective insurance marketing strategies isn’t just helpful; it’s essential. The right approach allows you to understand what truly motivates your audience, so you can craft campaigns that resonate, engage, and convert.

By tapping into the needs and behaviors of potential clients, you can choose the most impactful marketing tactics to drive interest and build trust. A well-executed strategy helps you stand out from the crowd, make meaningful connections, and consistently generate fresh leads that fuel long-term growth.

8 Best Strategies Every Marketer Should Be Aware of

When selecting the right strategies, numerous options are available, but choosing the most effective one that yields the best results is crucial. PPC advertising, social media marketing, influencer marketing, or even guerrilla marketing can be effective tactics.

Let’s take a look at these strategies and what they are in brief.

Fuel Profitable Paid Advertising

Paid advertising, or PPC insurance advertising, is a powerful and essential insurance advertising strategy. It allows insurance companies and agents to reach a highly targeted audience, increase brand visibility, and generate quality leads efficiently. With the help of effective and high-quality PPC ad networks, businesses can run tailored ad campaigns to connect with potential customers who are actively searching for insurance-related services.

One of the main advantages of PPC insurance advertising is the ability to control who sees your ads. Through Pay-Per-Click (PPC) advertising, marketers can target users based on specific keywords, demographics, locations, and interests. This means your insurance ads are shown only to users most likely to need them, improving the chances of conversions while minimizing wasted ad spend.

Additionally, paid advertising offers measurable results. Advertisers can track impressions, clicks, conversions, and other key metrics in real time, allowing them to optimize insurance campaigns for better performance. For example, if an ad targeting health insurance isn’t converting well, it can be adjusted or replaced quickly to improve ROI.

Know more about: How Insurance PPC Advertising Gives Companies the Edge

Marketing Through Email

When it comes to insurance, every customer wants to know one thing: what does it cover? That’s why it’s crucial to pitch your insurance services in a way that clearly highlights the benefits and real-life impact. This is where the power of email marketing for insurance truly shines. Not only can it keep interested leads engaged, but it can also reach those who may not be actively looking for insurance. With the right messaging, you can turn casual readers into loyal customers by showing them why they need your coverage.

Email is a powerful tool to build trust, deliver value, and drive conversions in the insurance industry. Through email, you not only target people but also reach your customers, and when guided with the right insurance offer, it can turn out to be beneficial for you.

Know More About: Leveraging Email Marketing for Increasing Sales During Holidays

Pay Only for Results, Affiliate Marketing

Turning your insurance web marketing goals into reality doesn’t have to be a distant dream; affiliate marketing makes it happen. For advertisers, this model allows them to pay only when they see results, making it a highly cost-effective strategy. With affiliate marketing, businesses only incur expenses when an affiliate marketer successfully generates a sale or leads. Even without conversions, website visits create lasting impressions, reducing acquisition costs and increasing brand awareness among people over time.

For effective results, insurance platforms should run a high-paying affiliate program that motivates affiliate marketers to perform well, as they can earn substantial income, which benefits both the affiliate and the platform. In simple terms, affiliate marketing is one of the best marketing strategies for insurance agents to consider for better outcomes.

Market Smarter with Social Channels

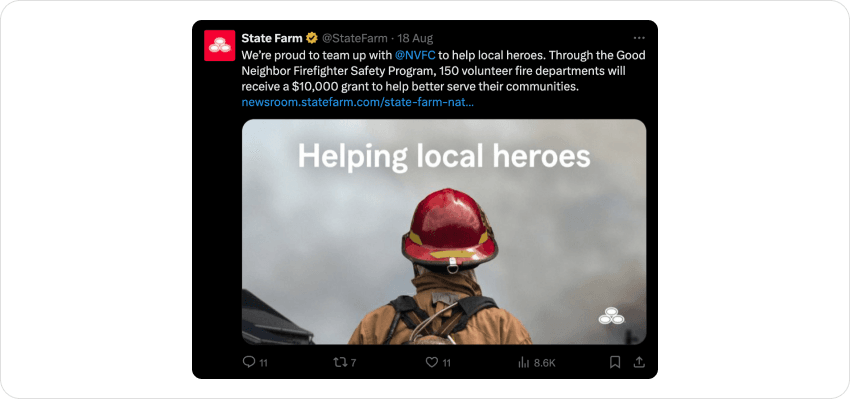

Many people are already familiar with social media marketing through sponsored posts or ads that appear while scrolling through platforms like Instagram, Facebook, and X (formerly Twitter). Social media marketing enables businesses to promote their products and services through a variety of digital channels, reaching audiences locally and globally.

Build a social media presence for your insurance that people really connect with, and use your posts to help them see the value of insurance. By using relevant hashtags, you can stay on trend and tap into what people are searching for. Through a strong social media presence, you can showcase your brand and make a lasting impression without much effort.

One of the key advantages of social media marketing is its advanced targeting capabilities. Marketers can tailor their insurance campaigns based on demographics, interests, behaviors, and more, ensuring that their message reaches the most relevant audience.

Learn About: How to Use Local Insurance Advertising to Boost Sales in Your City

Power Up with Influencers

Influencer marketing is a powerful strategy that involves partnering with content creators to promote your insurance products and services to their established audiences. By utilizing the trust and credibility influencers have established with their followers, your brand can foster genuine engagement and generate high-quality leads or conversions.

For influencers, promoting insurance products presents an opportunity to monetize their platforms through meaningful partnerships. When executed effectively, this approach creates a win-win scenario: brands gain visibility and trust, while influencers benefit from performance-based earnings. Partnering with a skilled influencer marketer is essential for achieving better results.

Invest in Content Marketing

If your content isn’t aligned with your goal, how can you influence people to buy your insurance, which ultimately benefits you financially? Investing in content marketing during an ad campaign is crucial because more engaging content leads to better conversion rates and sales.

Focus your content on catchy CTAs or on creating engaging, high-quality, and diverse content that educates and entertains your target audience while meeting specific business goals, such as lead generation or customer retention. Making people more knowledgeable about your content also sparks their interest in what you offer.

Read More About: Top Insurance Advertising Trends Every Marketer Should Know in 2025

Urgency Driven Offers

When finding insurance marketing strategies for insurance brokers, implementing this urgency-driven offers strategy can significantly benefit you. It is a powerful marketing strategy that creates a sense of limited time or opportunity, encouraging customers to act quickly to avoid missing out. In the insurance industry, this technique can effectively drive conversions by utilizing psychological triggers like fear of loss and scarcity.

For instance, offering a limited-time discount on premiums can prompt faster decision-making. An example could be: “Sign up before September 20th and get 10% off your first-year premium.” This creates a deadline, motivating potential clients to act rather than delay. This overall benefit helps you encourage people to consider purchasing insurance.

Guerrilla Marketing

Digital guerrilla marketing is a low-cost, creative strategy that uses surprise and originality to grab attention online. For insurance companies, it’s a way to break from formal, boring norms and connect with audiences through bold, engaging content on social media or websites, making insurance web marketing feel more relevant and memorable.

For example, a car insurance company might launch a viral video that starts lighthearted but ends with a realistic accident, paired with the message: “Accidents happen when you least expect them. Are you covered?” This emotional switch grabs attention and encourages reflection. In a competitive market, insurance brands can stand out by being bold, human, and emotionally resonant.

Digital guerrilla marketing allows you to reframe insurance as not just a necessity but as a smart, caring decision. Seeking out fresh guerrilla marketing ideas can help you create a compelling insurance ad campaign.

Final Point!

Having a well-established insurance marketing strategy is not just beneficial, but it also helps you stand out in the insurance industry, attracting the best clients and encouraging them to spend what you offer. Knowing the importance of paid advertising, email marketing, social media marketing, and influencer marketing is crucial for achieving better results for your insurance platform marketing.

Frequently Asked Questions (FAQs)

What are the best ways to market an insurance business in 2025?

Ans: In 2025, the most effective strategies for insurance marketing include:

- PPC advertising

- Email marketing

- Social media marketing

- Affiliate marketing

- Influencer partnerships

- Content marketing

- Urgency-driven offers

- Guerrilla marketing.

These tactics help insurance companies reach targeted audiences, generate leads, and stand out better in a competitive market.

Why is having an insurance marketing strategy important?

Ans: An insurance marketing strategy is essential because it helps you differentiate your brand, target the right audience, and build trust. With intense competition in the industry, a clear strategy ensures you can attract new clients.

Is affiliate marketing a good strategy for insurance companies?

Ans: Yes, affiliate marketing is a good strategy for insurance companies looking to get paid only when they get the desired result. You pay only when affiliates generate leads or sales, which makes it a cost-effective way to scale. A high-paying affiliate program can motivate marketers to promote your insurance plans aggressively and effectively.

What is guerrilla marketing, and how can it help insurance companies stand out?

Ans: Guerrilla marketing is a creative, low-cost strategy that relies on surprising and emotionally engaging content. For insurance companies, this could be a viral video, meme, or bold campaign that grabs attention and reframes insurance as a smart, human decision, not just a necessity.

How to increase insurance policy sales through marketing?

Ans: With the right insurance marketing strategies, you can help people find the insurance you’re selling and understand its importance to them. This overall helps you increase policy sales and maximize your profit. You can utilize PPC for insurance companies or social media marketing to achieve significantly better results.